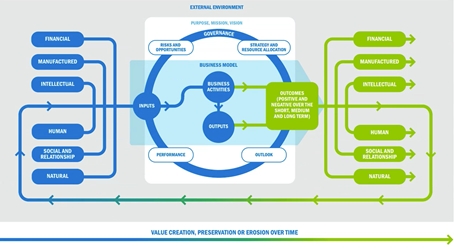

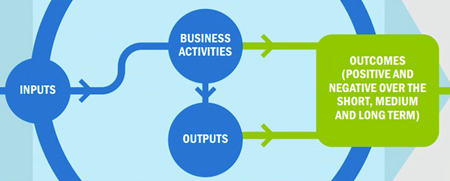

Integrated reporting focuses on disclosing the ability of an organization to create value in the short, medium and long term. An integrated report is a concise communication about how an organization interacts with the external environment, stakeholders and available resources – ‘capitals’ – to deliver value over time.

There are six capitals – i.e. stocks of value that increase and decrease through the organization’s activities : financial, manufactured, intellectual, human, social and natural.

While capitals might be categorized differently, organizations are required to consider all the forms of capital they use or affect.

Check some good examples of value creation models so far:

The framework provides organizations with guiding principles and content elements to be included in the integrated report but does not provide KPIs or measurement methods.

Guiding principles

Content elements

Find out more on best practices here

No fundamental changes has been implemented – 3 focus areas:

Clarity

Simplicity

Quality

Download here the revised framework

This latest version applies to reporting periods commencing 1 January 2022.

More insights and best practices? Check out the webinar

End of 2020, the International Integrated Reporting Council (IIRC) and the Sustainability Accounting Standards Board (SASB) announced their intention to merge into a unified organization, the Value Reporting Foundation.

Capital markets still need sound information linked to enterprise value creation, and can’t efficiently process information from a fragmented reporting landscape. The merger will enhance the work of CDP (Carbon Disclosure Project), CDSB (Climate Disclosure Standards Board), GRI (Global Reporting Initiative), IIRC and SASB in the Statement of Intent To Work Together Towards Comprehensive Corporate Reporting, highlighting a vision for a comprehensive corporate reporting system. The Value Reporting Foundation could eventually integrate other entities focused on enterprise value creation – CDSB signalled interest in entering into exploratory discussions in the coming months. The Foundation is also ready to engage with the efforts of the IFRS (International Financial Reporting Standards) Foundation, IOSCO (International Organization of Securities Commissions), EFRAG (European Financial Reporting Advisory Group), and others working towards global alignment on a corporate reporting system underlined Janine Guillot, CEO of SASB who will lead the Foundation.

The IR Framework and the SASB Standards are indeed complementary. IR describes all relevant value creation topics and the approach to integrating them in corporate thought and reporting. SASB provides the precise definitions of the data that should be reported for these topics in each industry. The Value Reporting Foundation will facilitate the use of both together.

Stay tuned !